Greater Public Funding Combined with Increasing Private Healthcare to Boost Imaging Market in CEE and Russia

|

By MedImaging International staff writers Posted on 04 Jun 2012 |

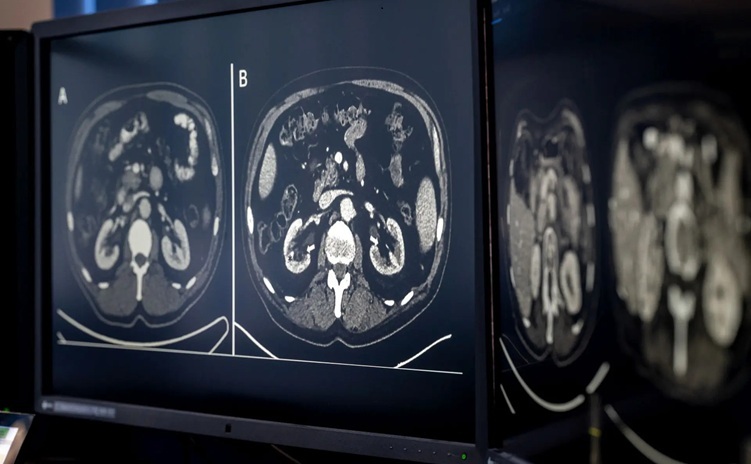

Mounting disease incidence and growing awareness about health issues will spur demand for medical imaging services across Central and Eastern Europe (CEE). However, the installed base of imaging devices in the region is insufficient, particularly in the high-end segment, such as magnetic resonance imaging (MRI), computed tomography (CT), and positron emission tomography (PET). At the same time, a large percentage of lower-end imaging modalities remains outdated and requires replacement. The availability of European Union (EU) funds and governmental financial support, as well as the increasing role of private healthcare, are set to help overcome this hurdle.

New analysis from Frost & Sullivan (Palo Alto, CA, USA), an international growth consultancy firm, revealed that the market earned revenues USD 1.42 billion in 2010 and estimates this to reach USD 2.34 billion in 2015. The research covers general X-ray, MRI, CT, ultrasound, molecular imaging, mammography, and picture archiving and communication system (PACS) segments across Russia, Hungary, Poland, the Czech Republic, Romania, and Bulgaria.

“The availability of EU funds for member states in the CEE, paralleled by governmental programs in Russia, will be an important source of financing for new equipment purchases and will contribute significantly to the development of the medical imaging market in CEE,” explained Frost & Sullivan industry analyst Dominika Grzywinska. “Even though budgets are planned until mid-term in cases of both Russia and CEE countries, their extension is highly likely in the long-term as well.”

In Russia, the 2020 Healthcare Development Program and National Project “Health” focus not only on bringing sophisticated technologies to the country and equipping healthcare facilities with expensive, high-end devices, but also on purchasing mid-range and low-end devices that are highly needed in regional hospitals. The total budgets for 2010-2012 allocated in these programs are approximately USD 16 billion.

At the same time, accession to the EU has provided countries such as the Czech Republic, Hungary, Poland, Bulgaria, and Romania, access to funding sources planned in the EU budget for 2007-2013. As a result, both private and public facilities can apply for EU funding support, which can subsidize the purchase of new medical equipment.

Affordability of medical imaging equipment in CEE countries and Russia is limited, which poses a challenge, particularly to private end-users. Private end-users have established their presence in less costly imaging segments, such as X-ray or ultrasound, and are expanding their presence into more costly, imaging diagnostics. Nevertheless, public healthcare facilities are the main purchasers of medical imaging equipment, especially in more expensive segments, such as PET, CT, or MRI.

“Furthermore, private facilities are frequently interested in refurbished equipment since they are more concerned about ROI [return on investment] than public facilities,” added Ms. Grzywinska. “Refurbished systems are in most demand for higher-priced modalities, such as MRI or CT. This situation is likely to limit the dynamics of medical imaging market growth in CEE countries and Russia.”

Alternative financing methods offered by the medical imaging vendors, as well as governmental support for public-private partnerships could contribute to more rapid market growth. “As end-users of medical imaging equipment do not always have sufficient financial resources to purchase the required device, alternative methods of financing, such as loans or leasing could help overcome this challenge,” advised Ms. Grzywinska. “Also, flexibility in payment of installments could be well-appreciated by the end-users. Another way to meet the growing demand for medical imaging services is by promoting public-private partnerships.”

Related Links:

Frost & Sullivan

New analysis from Frost & Sullivan (Palo Alto, CA, USA), an international growth consultancy firm, revealed that the market earned revenues USD 1.42 billion in 2010 and estimates this to reach USD 2.34 billion in 2015. The research covers general X-ray, MRI, CT, ultrasound, molecular imaging, mammography, and picture archiving and communication system (PACS) segments across Russia, Hungary, Poland, the Czech Republic, Romania, and Bulgaria.

“The availability of EU funds for member states in the CEE, paralleled by governmental programs in Russia, will be an important source of financing for new equipment purchases and will contribute significantly to the development of the medical imaging market in CEE,” explained Frost & Sullivan industry analyst Dominika Grzywinska. “Even though budgets are planned until mid-term in cases of both Russia and CEE countries, their extension is highly likely in the long-term as well.”

In Russia, the 2020 Healthcare Development Program and National Project “Health” focus not only on bringing sophisticated technologies to the country and equipping healthcare facilities with expensive, high-end devices, but also on purchasing mid-range and low-end devices that are highly needed in regional hospitals. The total budgets for 2010-2012 allocated in these programs are approximately USD 16 billion.

At the same time, accession to the EU has provided countries such as the Czech Republic, Hungary, Poland, Bulgaria, and Romania, access to funding sources planned in the EU budget for 2007-2013. As a result, both private and public facilities can apply for EU funding support, which can subsidize the purchase of new medical equipment.

Affordability of medical imaging equipment in CEE countries and Russia is limited, which poses a challenge, particularly to private end-users. Private end-users have established their presence in less costly imaging segments, such as X-ray or ultrasound, and are expanding their presence into more costly, imaging diagnostics. Nevertheless, public healthcare facilities are the main purchasers of medical imaging equipment, especially in more expensive segments, such as PET, CT, or MRI.

“Furthermore, private facilities are frequently interested in refurbished equipment since they are more concerned about ROI [return on investment] than public facilities,” added Ms. Grzywinska. “Refurbished systems are in most demand for higher-priced modalities, such as MRI or CT. This situation is likely to limit the dynamics of medical imaging market growth in CEE countries and Russia.”

Alternative financing methods offered by the medical imaging vendors, as well as governmental support for public-private partnerships could contribute to more rapid market growth. “As end-users of medical imaging equipment do not always have sufficient financial resources to purchase the required device, alternative methods of financing, such as loans or leasing could help overcome this challenge,” advised Ms. Grzywinska. “Also, flexibility in payment of installments could be well-appreciated by the end-users. Another way to meet the growing demand for medical imaging services is by promoting public-private partnerships.”

Related Links:

Frost & Sullivan

Latest Industry News News

- GE HealthCare and NVIDIA Collaboration to Reimagine Diagnostic Imaging

- Patient-Specific 3D-Printed Phantoms Transform CT Imaging

- Siemens and Sectra Collaborate on Enhancing Radiology Workflows

- Bracco Diagnostics and ColoWatch Partner to Expand Availability CRC Screening Tests Using Virtual Colonoscopy

- Mindray Partners with TeleRay to Streamline Ultrasound Delivery

- Philips and Medtronic Partner on Stroke Care

- Siemens and Medtronic Enter into Global Partnership for Advancing Spine Care Imaging Technologies

- RSNA 2024 Technical Exhibits to Showcase Latest Advances in Radiology

- Bracco Collaborates with Arrayus on Microbubble-Assisted Focused Ultrasound Therapy for Pancreatic Cancer

- Innovative Collaboration to Enhance Ischemic Stroke Detection and Elevate Standards in Diagnostic Imaging

- RSNA 2024 Registration Opens

- Microsoft collaborates with Leading Academic Medical Systems to Advance AI in Medical Imaging

- GE HealthCare Acquires Intelligent Ultrasound Group’s Clinical Artificial Intelligence Business

- Bayer and Rad AI Collaborate on Expanding Use of Cutting Edge AI Radiology Operational Solutions

- Polish Med-Tech Company BrainScan to Expand Extensively into Foreign Markets

- Hologic Acquires UK-Based Breast Surgical Guidance Company Endomagnetics Ltd.

Channels

Radiography

view channel

Machine Learning Algorithm Identifies Cardiovascular Risk from Routine Bone Density Scans

A new study published in the Journal of Bone and Mineral Research reveals that an automated machine learning program can predict the risk of cardiovascular events and falls or fractures by analyzing bone... Read more

AI Improves Early Detection of Interval Breast Cancers

Interval breast cancers, which occur between routine screenings, are easier to treat when detected earlier. Early detection can reduce the need for aggressive treatments and improve the chances of better outcomes.... Read more

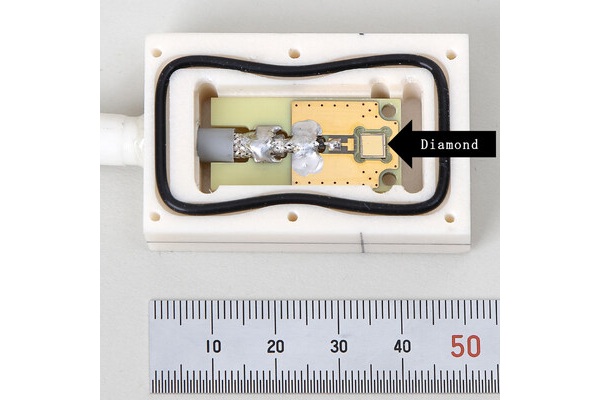

World's Largest Class Single Crystal Diamond Radiation Detector Opens New Possibilities for Diagnostic Imaging

Diamonds possess ideal physical properties for radiation detection, such as exceptional thermal and chemical stability along with a quick response time. Made of carbon with an atomic number of six, diamonds... Read moreMRI

view channel

New MRI Technique Reveals Hidden Heart Issues

Traditional exercise stress tests conducted within an MRI machine require patients to lie flat, a position that artificially improves heart function by increasing stroke volume due to gravity-driven blood... Read more

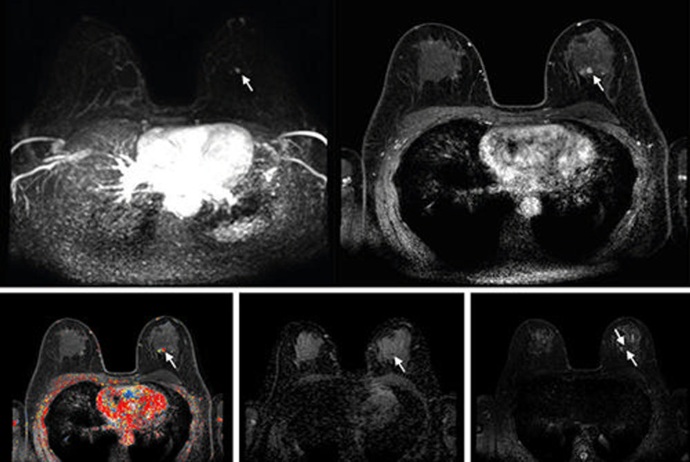

Shorter MRI Exam Effectively Detects Cancer in Dense Breasts

Women with extremely dense breasts face a higher risk of missed breast cancer diagnoses, as dense glandular and fibrous tissue can obscure tumors on mammograms. While breast MRI is recommended for supplemental... Read moreUltrasound

view channel

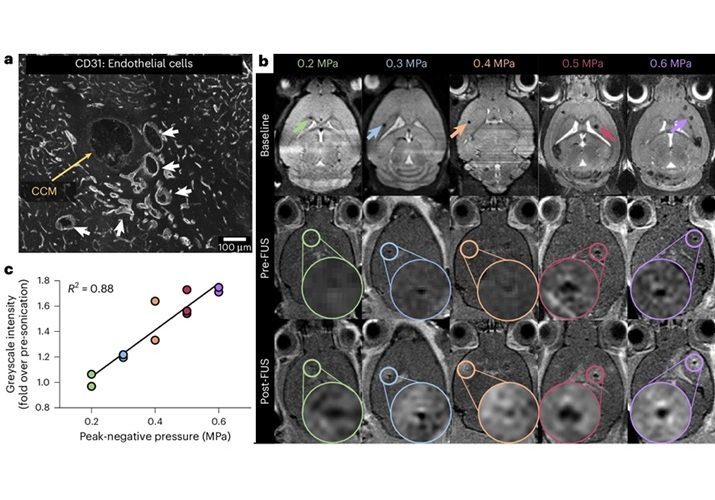

New Incision-Free Technique Halts Growth of Debilitating Brain Lesions

Cerebral cavernous malformations (CCMs), also known as cavernomas, are abnormal clusters of blood vessels that can grow in the brain, spinal cord, or other parts of the body. While most cases remain asymptomatic,... Read more.jpeg)

AI-Powered Lung Ultrasound Outperforms Human Experts in Tuberculosis Diagnosis

Despite global declines in tuberculosis (TB) rates in previous years, the incidence of TB rose by 4.6% from 2020 to 2023. Early screening and rapid diagnosis are essential elements of the World Health... Read moreNuclear Medicine

view channel

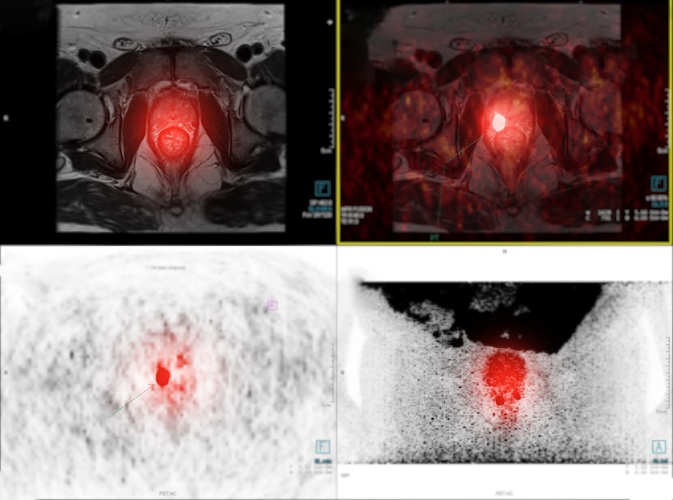

New Imaging Approach Could Reduce Need for Biopsies to Monitor Prostate Cancer

Prostate cancer is the second leading cause of cancer-related death among men in the United States. However, the majority of older men diagnosed with prostate cancer have slow-growing, low-risk forms of... Read more

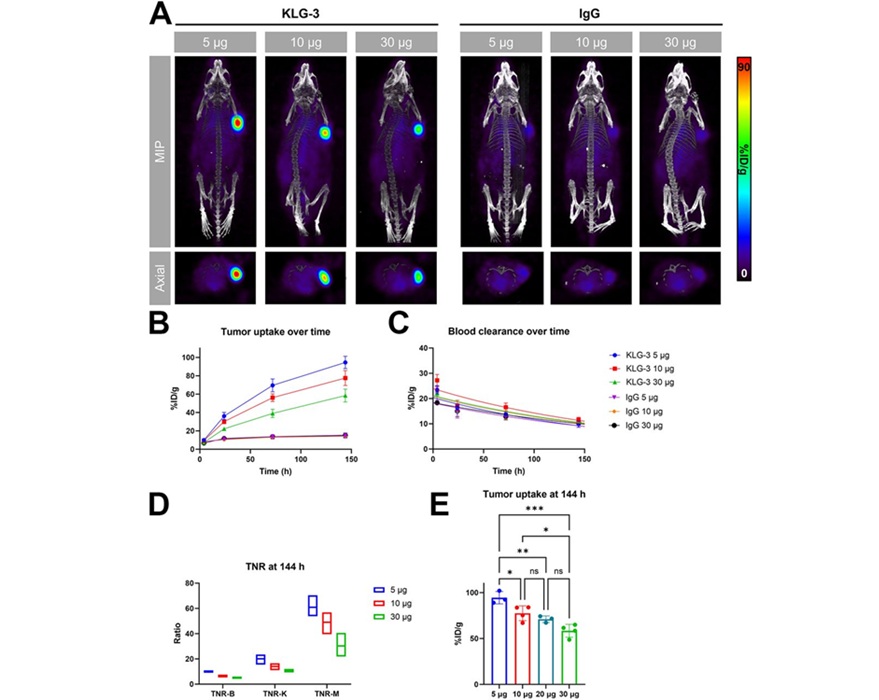

Novel Radiolabeled Antibody Improves Diagnosis and Treatment of Solid Tumors

Interleukin-13 receptor α-2 (IL13Rα2) is a cell surface receptor commonly found in solid tumors such as glioblastoma, melanoma, and breast cancer. It is minimally expressed in normal tissues, making it... Read moreGeneral/Advanced Imaging

view channel

First-Of-Its-Kind Wearable Device Offers Revolutionary Alternative to CT Scans

Currently, patients with conditions such as heart failure, pneumonia, or respiratory distress often require multiple imaging procedures that are intermittent, disruptive, and involve high levels of radiation.... Read more

AI-Based CT Scan Analysis Predicts Early-Stage Kidney Damage Due to Cancer Treatments

Radioligand therapy, a form of targeted nuclear medicine, has recently gained attention for its potential in treating specific types of tumors. However, one of the potential side effects of this therapy... Read moreImaging IT

view channel

New Google Cloud Medical Imaging Suite Makes Imaging Healthcare Data More Accessible

Medical imaging is a critical tool used to diagnose patients, and there are billions of medical images scanned globally each year. Imaging data accounts for about 90% of all healthcare data1 and, until... Read more