Global X-Ray Market Hits USD 10 Billion in 2012 and Forecast to Reach USD 12 Billion in 2017

|

By MedImaging International staff writers Posted on 09 Sep 2013 |

The global market for X-ray equipment used for medical, dental, veterinary applications and other purposes expanded to more than USD 10 billion in 2012, and is set to climb by 18% and predicted to reach USD 12 billion in 2017.

Growth will be fueled by the sustained digitalization of X-ray systems and increasing healthcare investment in emerging regions, according to the medical service at IMS Research, an international market research company, now part of IHS, Inc. (Englewood, CO, USA).

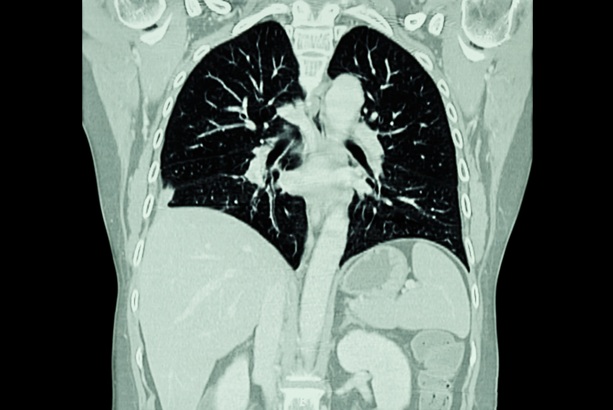

The global X-ray market includes the categories: general radiography, fluoroscopy, mammography, interventional, mobile C-arm, veterinary, and dental. “General radiography is undergoing a major transition away from film and toward digital flat-panel detector [FPD] technology, with more affordable solutions such as retrofit kits driving this migration in many cash-strapped regions,” said Sarah Jones, analyst for medical electronics at IHS. “Shipments of FPD and retrofit FPD systems accounted for an estimated 15% of annual general radiography shipments in 2012. That total is expected to rise to 25% in 2017.”

The mammography market is already overshadowed by FPD full-field digital mammography (FPD-FFDM) equipment, led by adoption in mature regions. FPD-FFDM, by contrast, uptake in emerging regions is relatively low, with few healthcare providers able to buy the expensive equipment and demand for breast screening being very low.

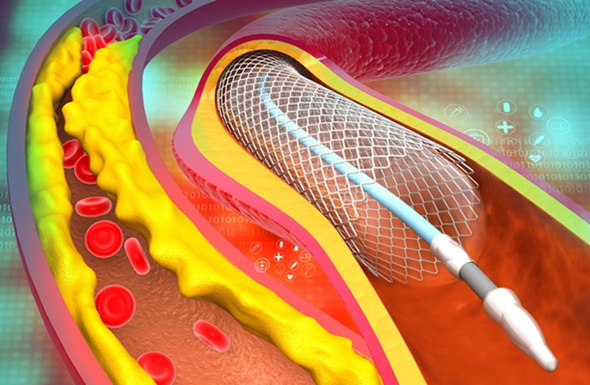

Interventional and mobile C-arm equipment, in the meantime, is benefiting from a growing trend toward minimally invasive surgery. Minimally invasive surgery decreases patient hospital stays and increases patient throughput. More cutting-edge systems with digital technology and advanced navigation software are driving growth in mobile C-arm X-ray. Interventional X-ray is already dominated by digital technology and is being spurred by new installations of hybrid operating hybrid operating rooms that combine multiple imaging modalities and full surgical equipment in one room.

Hospitals, for their part, are becoming more receptive to new procedures like transcatheter aortic valve implantation (TAVI), with the use of medical imaging as an alternative to open-heart surgery. These procedures now are being performed using high-end mobile C-arm X-ray equipment, requiring FPD technology.

The dental X-ray segment currently is dominated by analog film. However, a major shift to digital sensors and photo-stimulable phosphor (PSP) imaging is occurring. Extraoral imaging is also increasing in popularity, with more complementary metal-oxide-semiconductor (CMOS)-based FPD detectors being used.

Challenging global economic conditions have substantially impacted the X-ray market. In the short term, delayed purchasing and slower demand are predicted to continue. However, hard times are also creating an opportunity for lower-cost digital solutions, such as retrofit FPD panels/kits, to penetrate the market. This is because such products offer viable, low-cost stopgap solutions for healthcare providers affected by spending cuts.

Over the longer term, the global X-ray market is predicted to recover. Emerging regions will be the key market drivers, especially in China, Latin America, India, and parts of Southeast Asia. FPD also will become the most widespread technology type, due to increased efficiency, image quality, and lower lifetime cost of ownership.

Moreover, the continued digitization of healthcare will maintain demand for digital X-ray, with FPD X-ray systems globally forecast to grow the fastest out of all product types.

IHS provides information, insight, and analytics in key areas that shape the business environment.

Related Links:

IHS

Growth will be fueled by the sustained digitalization of X-ray systems and increasing healthcare investment in emerging regions, according to the medical service at IMS Research, an international market research company, now part of IHS, Inc. (Englewood, CO, USA).

The global X-ray market includes the categories: general radiography, fluoroscopy, mammography, interventional, mobile C-arm, veterinary, and dental. “General radiography is undergoing a major transition away from film and toward digital flat-panel detector [FPD] technology, with more affordable solutions such as retrofit kits driving this migration in many cash-strapped regions,” said Sarah Jones, analyst for medical electronics at IHS. “Shipments of FPD and retrofit FPD systems accounted for an estimated 15% of annual general radiography shipments in 2012. That total is expected to rise to 25% in 2017.”

The mammography market is already overshadowed by FPD full-field digital mammography (FPD-FFDM) equipment, led by adoption in mature regions. FPD-FFDM, by contrast, uptake in emerging regions is relatively low, with few healthcare providers able to buy the expensive equipment and demand for breast screening being very low.

Interventional and mobile C-arm equipment, in the meantime, is benefiting from a growing trend toward minimally invasive surgery. Minimally invasive surgery decreases patient hospital stays and increases patient throughput. More cutting-edge systems with digital technology and advanced navigation software are driving growth in mobile C-arm X-ray. Interventional X-ray is already dominated by digital technology and is being spurred by new installations of hybrid operating hybrid operating rooms that combine multiple imaging modalities and full surgical equipment in one room.

Hospitals, for their part, are becoming more receptive to new procedures like transcatheter aortic valve implantation (TAVI), with the use of medical imaging as an alternative to open-heart surgery. These procedures now are being performed using high-end mobile C-arm X-ray equipment, requiring FPD technology.

The dental X-ray segment currently is dominated by analog film. However, a major shift to digital sensors and photo-stimulable phosphor (PSP) imaging is occurring. Extraoral imaging is also increasing in popularity, with more complementary metal-oxide-semiconductor (CMOS)-based FPD detectors being used.

Challenging global economic conditions have substantially impacted the X-ray market. In the short term, delayed purchasing and slower demand are predicted to continue. However, hard times are also creating an opportunity for lower-cost digital solutions, such as retrofit FPD panels/kits, to penetrate the market. This is because such products offer viable, low-cost stopgap solutions for healthcare providers affected by spending cuts.

Over the longer term, the global X-ray market is predicted to recover. Emerging regions will be the key market drivers, especially in China, Latin America, India, and parts of Southeast Asia. FPD also will become the most widespread technology type, due to increased efficiency, image quality, and lower lifetime cost of ownership.

Moreover, the continued digitization of healthcare will maintain demand for digital X-ray, with FPD X-ray systems globally forecast to grow the fastest out of all product types.

IHS provides information, insight, and analytics in key areas that shape the business environment.

Related Links:

IHS

Latest Industry News News

- GE HealthCare and NVIDIA Collaboration to Reimagine Diagnostic Imaging

- Patient-Specific 3D-Printed Phantoms Transform CT Imaging

- Siemens and Sectra Collaborate on Enhancing Radiology Workflows

- Bracco Diagnostics and ColoWatch Partner to Expand Availability CRC Screening Tests Using Virtual Colonoscopy

- Mindray Partners with TeleRay to Streamline Ultrasound Delivery

- Philips and Medtronic Partner on Stroke Care

- Siemens and Medtronic Enter into Global Partnership for Advancing Spine Care Imaging Technologies

- RSNA 2024 Technical Exhibits to Showcase Latest Advances in Radiology

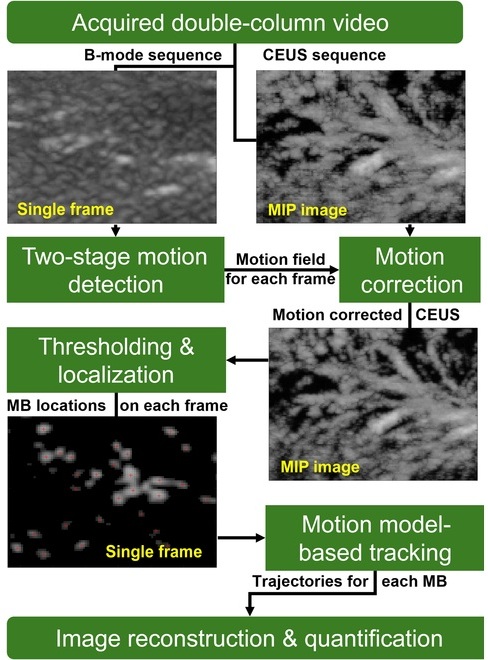

- Bracco Collaborates with Arrayus on Microbubble-Assisted Focused Ultrasound Therapy for Pancreatic Cancer

- Innovative Collaboration to Enhance Ischemic Stroke Detection and Elevate Standards in Diagnostic Imaging

- RSNA 2024 Registration Opens

- Microsoft collaborates with Leading Academic Medical Systems to Advance AI in Medical Imaging

- GE HealthCare Acquires Intelligent Ultrasound Group’s Clinical Artificial Intelligence Business

- Bayer and Rad AI Collaborate on Expanding Use of Cutting Edge AI Radiology Operational Solutions

- Polish Med-Tech Company BrainScan to Expand Extensively into Foreign Markets

- Hologic Acquires UK-Based Breast Surgical Guidance Company Endomagnetics Ltd.

Channels

Radiography

view channel

AI Improves Early Detection of Interval Breast Cancers

Interval breast cancers, which occur between routine screenings, are easier to treat when detected earlier. Early detection can reduce the need for aggressive treatments and improve the chances of better outcomes.... Read more

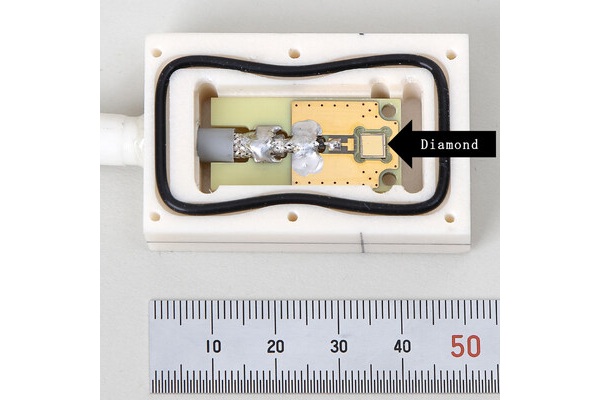

World's Largest Class Single Crystal Diamond Radiation Detector Opens New Possibilities for Diagnostic Imaging

Diamonds possess ideal physical properties for radiation detection, such as exceptional thermal and chemical stability along with a quick response time. Made of carbon with an atomic number of six, diamonds... Read moreMRI

view channel

Cutting-Edge MRI Technology to Revolutionize Diagnosis of Common Heart Problem

Aortic stenosis is a common and potentially life-threatening heart condition. It occurs when the aortic valve, which regulates blood flow from the heart to the rest of the body, becomes stiff and narrow.... Read more

New MRI Technique Reveals True Heart Age to Prevent Attacks and Strokes

Heart disease remains one of the leading causes of death worldwide. Individuals with conditions such as diabetes or obesity often experience accelerated aging of their hearts, sometimes by decades.... Read more

AI Tool Predicts Relapse of Pediatric Brain Cancer from Brain MRI Scans

Many pediatric gliomas are treatable with surgery alone, but relapses can be catastrophic. Predicting which patients are at risk for recurrence remains challenging, leading to frequent follow-ups with... Read more

AI Tool Tracks Effectiveness of Multiple Sclerosis Treatments Using Brain MRI Scans

Multiple sclerosis (MS) is a condition in which the immune system attacks the brain and spinal cord, leading to impairments in movement, sensation, and cognition. Magnetic Resonance Imaging (MRI) markers... Read moreUltrasound

view channel.jpeg)

AI-Powered Lung Ultrasound Outperforms Human Experts in Tuberculosis Diagnosis

Despite global declines in tuberculosis (TB) rates in previous years, the incidence of TB rose by 4.6% from 2020 to 2023. Early screening and rapid diagnosis are essential elements of the World Health... Read more

AI Identifies Heart Valve Disease from Common Imaging Test

Tricuspid regurgitation is a condition where the heart's tricuspid valve does not close completely during contraction, leading to backward blood flow, which can result in heart failure. A new artificial... Read moreNuclear Medicine

view channel

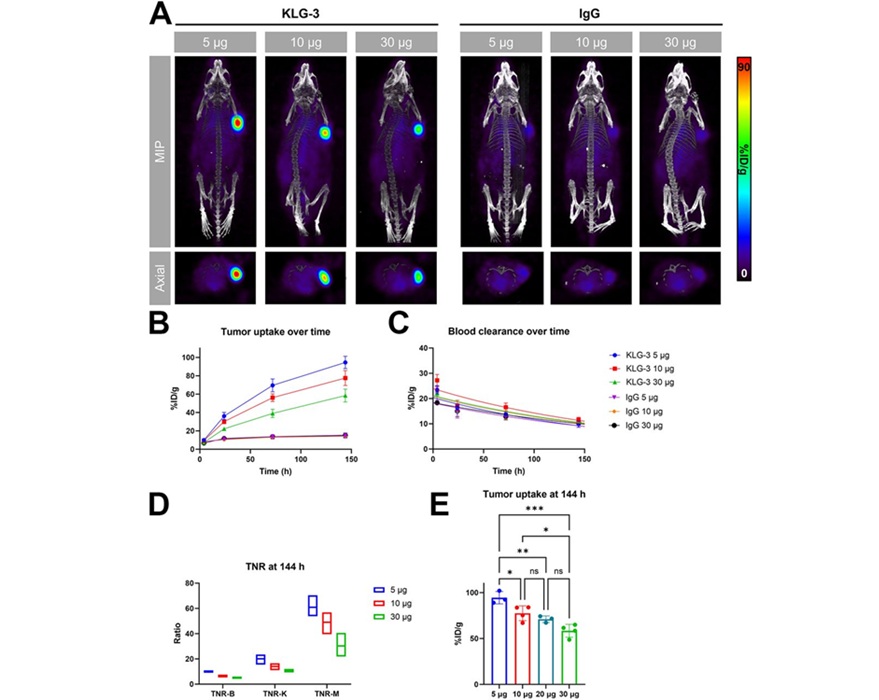

Novel Radiolabeled Antibody Improves Diagnosis and Treatment of Solid Tumors

Interleukin-13 receptor α-2 (IL13Rα2) is a cell surface receptor commonly found in solid tumors such as glioblastoma, melanoma, and breast cancer. It is minimally expressed in normal tissues, making it... Read more

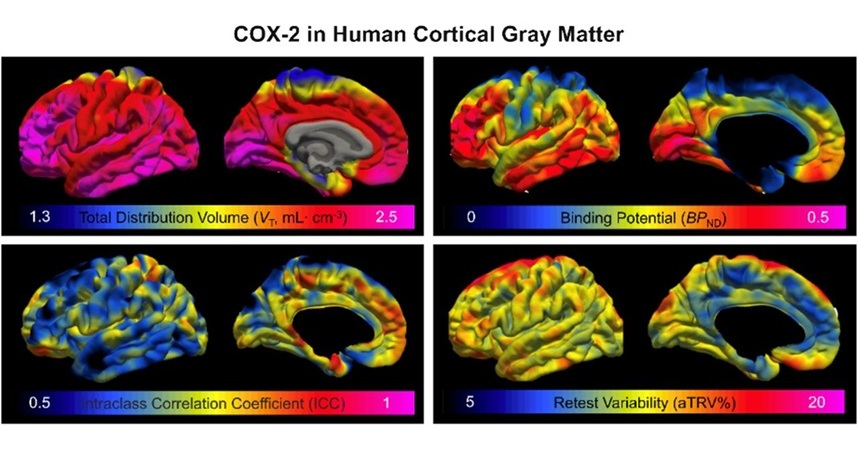

Novel PET Imaging Approach Offers Never-Before-Seen View of Neuroinflammation

COX-2, an enzyme that plays a key role in brain inflammation, can be significantly upregulated by inflammatory stimuli and neuroexcitation. Researchers suggest that COX-2 density in the brain could serve... Read moreGeneral/Advanced Imaging

view channel

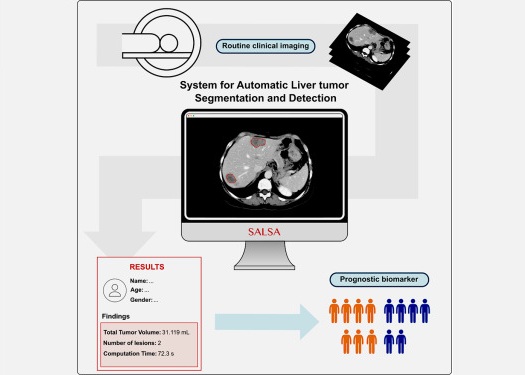

CT-Based Deep Learning-Driven Tool to Enhance Liver Cancer Diagnosis

Medical imaging, such as computed tomography (CT) scans, plays a crucial role in oncology, offering essential data for cancer detection, treatment planning, and monitoring of response to therapies.... Read more

AI-Powered Imaging System Improves Lung Cancer Diagnosis

Given the need to detect lung cancer at earlier stages, there is an increasing need for a definitive diagnostic pathway for patients with suspicious pulmonary nodules. However, obtaining tissue samples... Read moreImaging IT

view channel

New Google Cloud Medical Imaging Suite Makes Imaging Healthcare Data More Accessible

Medical imaging is a critical tool used to diagnose patients, and there are billions of medical images scanned globally each year. Imaging data accounts for about 90% of all healthcare data1 and, until... Read more