Demand for COVID-19 Diagnosis to Help Point of Care CT Imaging Market Reach USD 276.9 Million by 2027

|

By MedImaging International staff writers Posted on 26 Nov 2020 |

Illustration

The global point of care (PoC) Computed Tomography (CT) imaging market was valued at USD 184.4 million in 2019 and is expected to expand at a CAGR of 5.2% from 2020 to 2027 to reach USD 276.9 million by 2027, driven by the growing prevalence of neurological conditions and increasing burden of COVID-19 diagnosis.

These are the latest findings of Grand View Research, Inc. (San Francisco, CA, USA), a global market research publishing & management consulting firm.

PoC imaging provides instant diagnosis and treatment, thus helping in reducing the number of visits to medical settings. The effectiveness of PoC CT imaging in providing prompt results is expected to drive the demand for these systems in the coming years. The growing prevalence of neurological conditions, including traumatic brain injury and brain tumor, is expected to drive the growth of the PoC CT imaging market. Additionally, the increasing burden due to COVID-19 is leading people to opt for PoC CT imaging to identify the problem. As the demand for the PoC CT imaging is increasing, outpatient settings such as Ambulatory Surgery Centers (ASCs), hospitals, and clinics are widely installing the devices.

Patients seeking PoC diagnostic devices prefer outpatient settings over the hospital to avoid long wait time and extra hospital-associated expenses. Therefore, market players are expected to provide PoC CT imaging in these settings are developing compact devices that can be easily accommodated and accessed. Many players are adding mobility as well to the compact devices so that these devices can be carried to different departments and locations, especially, where the need for COVID-19 diagnosis is high. Market players are also forming strategic alliances with various distributors to provide advanced PoC CT imaging devices for COVID-19 diagnosis.

A large number of clinical trial studies are being conducted on PoC CT imaging devices to understand their effectiveness and efficiency in diagnosing various diseases. Many research centers and institutes are, therefore are installing PoC CT devices for conducting studies. Furthermore, market players are forming alliances to enhance their knowledge of PoC CT imaging by support educational groups at research institutions.

On the basis of product, the full-sized PoC CT scanners segment held the largest share of the PoC CT imaging market in 2019 due to the presence of a large patient pool and the development of weight-bearing CT scanners. However, the compact PoC CT scanners segment is expected to drive the PoC CT imaging market during the forecast period due to the growing pandemic situation and increasing adoption of CT imaging in outpatient settings.

By application, the neurology segment held the largest share of the PoC CT imaging market in 2019 owing to the increasing number of neurological disorder cases. However, the respiratory segment is expected to grow at the fastest rate during the forecast period due to the increasing respiratory problems faced during the pandemic and growing demand for early diagnosis due to COVID-19.

Based on end-use, the hospital segment held the largest revenue share of the PoC CT imaging market in 2019 owing to the increasing installation of advanced PoC CT imaging devices for enhanced diagnosis. However, the ambulatory surgery centers (ASCs) segment is expected to grow at the fastest rate during the forecast period due to the easy availability of PoC CT imaging in these centers at affordable prices.

Geographically, North America dominated the global PoC CT imaging market in 2019 and accounted for the largest revenue share owing to the rising adoption of advanced testing devices and the presence of major market players in the region. However, the Asia Pacific market is expected to grow at the fastest rate during the forecast period mainly due to increasing strategic alliances between players and distributors to provide PoC CT imaging in the region.

Related Links:

Grand View Research, Inc.

These are the latest findings of Grand View Research, Inc. (San Francisco, CA, USA), a global market research publishing & management consulting firm.

PoC imaging provides instant diagnosis and treatment, thus helping in reducing the number of visits to medical settings. The effectiveness of PoC CT imaging in providing prompt results is expected to drive the demand for these systems in the coming years. The growing prevalence of neurological conditions, including traumatic brain injury and brain tumor, is expected to drive the growth of the PoC CT imaging market. Additionally, the increasing burden due to COVID-19 is leading people to opt for PoC CT imaging to identify the problem. As the demand for the PoC CT imaging is increasing, outpatient settings such as Ambulatory Surgery Centers (ASCs), hospitals, and clinics are widely installing the devices.

Patients seeking PoC diagnostic devices prefer outpatient settings over the hospital to avoid long wait time and extra hospital-associated expenses. Therefore, market players are expected to provide PoC CT imaging in these settings are developing compact devices that can be easily accommodated and accessed. Many players are adding mobility as well to the compact devices so that these devices can be carried to different departments and locations, especially, where the need for COVID-19 diagnosis is high. Market players are also forming strategic alliances with various distributors to provide advanced PoC CT imaging devices for COVID-19 diagnosis.

A large number of clinical trial studies are being conducted on PoC CT imaging devices to understand their effectiveness and efficiency in diagnosing various diseases. Many research centers and institutes are, therefore are installing PoC CT devices for conducting studies. Furthermore, market players are forming alliances to enhance their knowledge of PoC CT imaging by support educational groups at research institutions.

On the basis of product, the full-sized PoC CT scanners segment held the largest share of the PoC CT imaging market in 2019 due to the presence of a large patient pool and the development of weight-bearing CT scanners. However, the compact PoC CT scanners segment is expected to drive the PoC CT imaging market during the forecast period due to the growing pandemic situation and increasing adoption of CT imaging in outpatient settings.

By application, the neurology segment held the largest share of the PoC CT imaging market in 2019 owing to the increasing number of neurological disorder cases. However, the respiratory segment is expected to grow at the fastest rate during the forecast period due to the increasing respiratory problems faced during the pandemic and growing demand for early diagnosis due to COVID-19.

Based on end-use, the hospital segment held the largest revenue share of the PoC CT imaging market in 2019 owing to the increasing installation of advanced PoC CT imaging devices for enhanced diagnosis. However, the ambulatory surgery centers (ASCs) segment is expected to grow at the fastest rate during the forecast period due to the easy availability of PoC CT imaging in these centers at affordable prices.

Geographically, North America dominated the global PoC CT imaging market in 2019 and accounted for the largest revenue share owing to the rising adoption of advanced testing devices and the presence of major market players in the region. However, the Asia Pacific market is expected to grow at the fastest rate during the forecast period mainly due to increasing strategic alliances between players and distributors to provide PoC CT imaging in the region.

Related Links:

Grand View Research, Inc.

Latest Industry News News

- Bayer and Google Partner on New AI Product for Radiologists

- Samsung and Bracco Enter Into New Diagnostic Ultrasound Technology Agreement

- IBA Acquires Radcal to Expand Medical Imaging Quality Assurance Offering

- International Societies Suggest Key Considerations for AI Radiology Tools

- Samsung's X-Ray Devices to Be Powered by Lunit AI Solutions for Advanced Chest Screening

- Canon Medical and Olympus Collaborate on Endoscopic Ultrasound Systems

- GE HealthCare Acquires AI Imaging Analysis Company MIM Software

- First Ever International Criteria Lays Foundation for Improved Diagnostic Imaging of Brain Tumors

- RSNA Unveils 10 Most Cited Radiology Studies of 2023

- RSNA 2023 Technical Exhibits to Offer Innovations in AI, 3D Printing and More

- AI Medical Imaging Products to Increase Five-Fold by 2035, Finds Study

- RSNA 2023 Technical Exhibits to Highlight Latest Medical Imaging Innovations

- AI-Powered Technologies to Aid Interpretation of X-Ray and MRI Images for Improved Disease Diagnosis

- Hologic and Bayer Partner to Improve Mammography Imaging

- Global Fixed and Mobile C-Arms Market Driven by Increasing Surgical Procedures

- Global Contrast Enhanced Ultrasound Market Driven by Demand for Early Detection of Chronic Diseases

Channels

Radiography

view channel

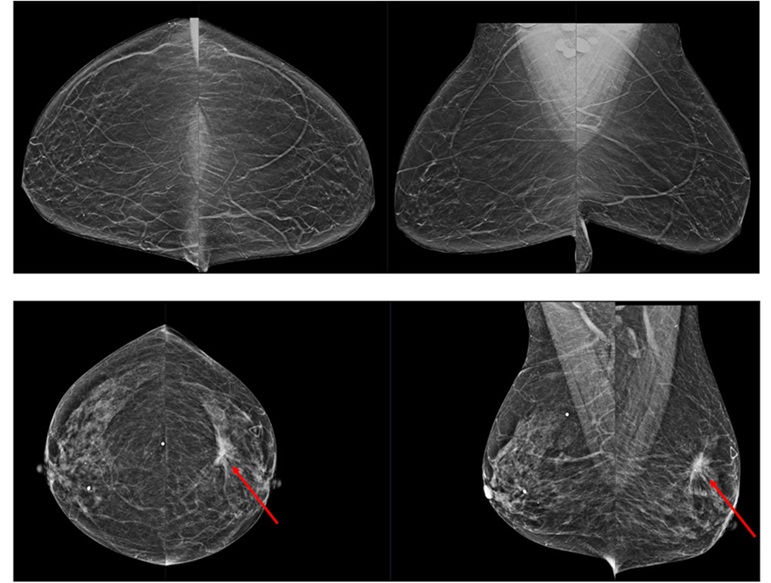

Novel Breast Imaging System Proves As Effective As Mammography

Breast cancer remains the most frequently diagnosed cancer among women. It is projected that one in eight women will be diagnosed with breast cancer during her lifetime, and one in 42 women who turn 50... Read more

AI Assistance Improves Breast-Cancer Screening by Reducing False Positives

Radiologists typically detect one case of cancer for every 200 mammograms reviewed. However, these evaluations often result in false positives, leading to unnecessary patient recalls for additional testing,... Read moreMRI

view channel

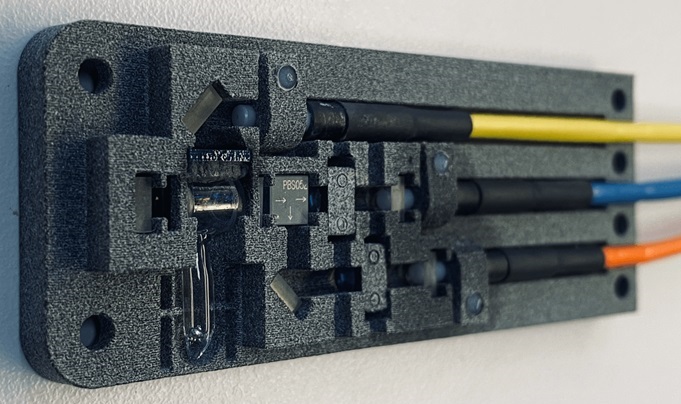

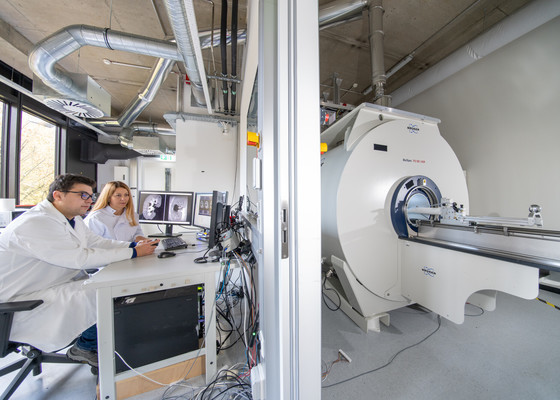

World's First Sensor Detects Errors in MRI Scans Using Laser Light and Gas

MRI scanners are daily tools for doctors and healthcare professionals, providing unparalleled 3D imaging of the brain, vital organs, and soft tissues, far surpassing other imaging technologies in quality.... Read more

Diamond Dust Could Offer New Contrast Agent Option for Future MRI Scans

Gadolinium, a heavy metal used for over three decades as a contrast agent in medical imaging, enhances the clarity of MRI scans by highlighting affected areas. Despite its utility, gadolinium not only... Read more.jpg)

Combining MRI with PSA Testing Improves Clinical Outcomes for Prostate Cancer Patients

Prostate cancer is a leading health concern globally, consistently being one of the most common types of cancer among men and a major cause of cancer-related deaths. In the United States, it is the most... Read moreUltrasound

view channel

Largest Model Trained On Echocardiography Images Assesses Heart Structure and Function

Foundation models represent an exciting frontier in generative artificial intelligence (AI), yet many lack the specialized medical data needed to make them applicable in healthcare settings.... Read more.jpg)

Groundbreaking Technology Enables Precise, Automatic Measurement of Peripheral Blood Vessels

The current standard of care of using angiographic information is often inadequate for accurately assessing vessel size in the estimated 20 million people in the U.S. who suffer from peripheral vascular disease.... Read more

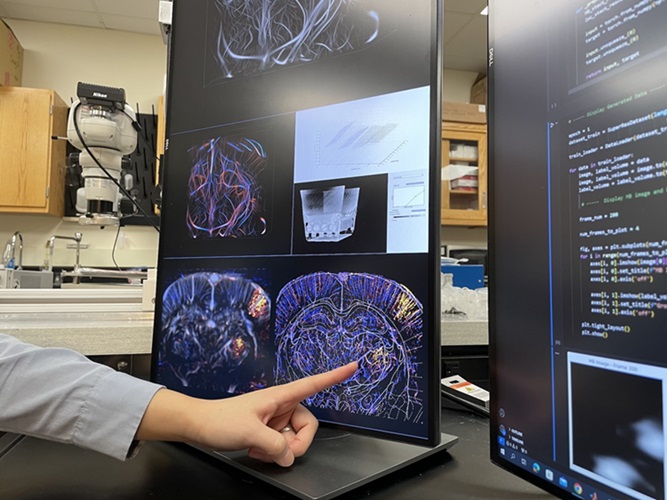

Deep Learning Advances Super-Resolution Ultrasound Imaging

Ultrasound localization microscopy (ULM) is an advanced imaging technique that offers high-resolution visualization of microvascular structures. It employs microbubbles, FDA-approved contrast agents, injected... Read more

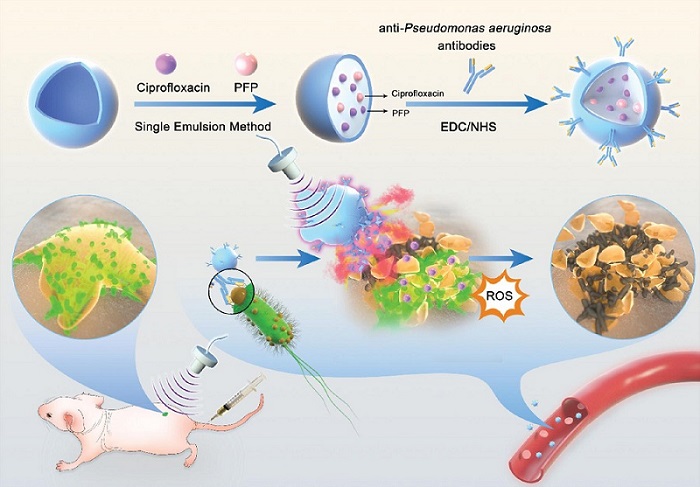

Novel Ultrasound-Launched Targeted Nanoparticle Eliminates Biofilm and Bacterial Infection

Biofilms, formed by bacteria aggregating into dense communities for protection against harsh environmental conditions, are a significant contributor to various infectious diseases. Biofilms frequently... Read moreNuclear Medicine

view channel

New Imaging Technique Monitors Inflammation Disorders without Radiation Exposure

Imaging inflammation using traditional radiological techniques presents significant challenges, including radiation exposure, poor image quality, high costs, and invasive procedures. Now, new contrast... Read more

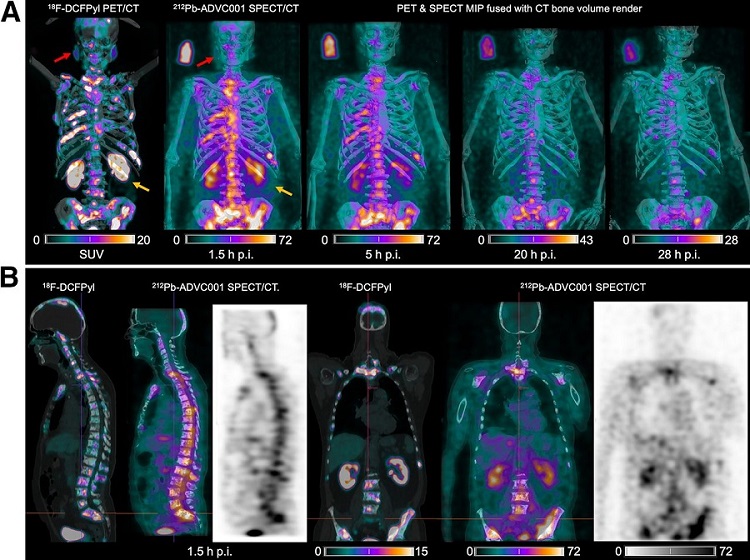

New SPECT/CT Technique Could Change Imaging Practices and Increase Patient Access

The development of lead-212 (212Pb)-PSMA–based targeted alpha therapy (TAT) is garnering significant interest in treating patients with metastatic castration-resistant prostate cancer. The imaging of 212Pb,... Read moreNew Radiotheranostic System Detects and Treats Ovarian Cancer Noninvasively

Ovarian cancer is the most lethal gynecological cancer, with less than a 30% five-year survival rate for those diagnosed in late stages. Despite surgery and platinum-based chemotherapy being the standard... Read more

AI System Automatically and Reliably Detects Cardiac Amyloidosis Using Scintigraphy Imaging

Cardiac amyloidosis, a condition characterized by the buildup of abnormal protein deposits (amyloids) in the heart muscle, severely affects heart function and can lead to heart failure or death without... Read moreGeneral/Advanced Imaging

view channel

PET Scans Reveal Hidden Inflammation in Multiple Sclerosis Patients

A key challenge for clinicians treating patients with multiple sclerosis (MS) is that after a certain amount of time, they continue to worsen even though their MRIs show no change. A new study has now... Read more

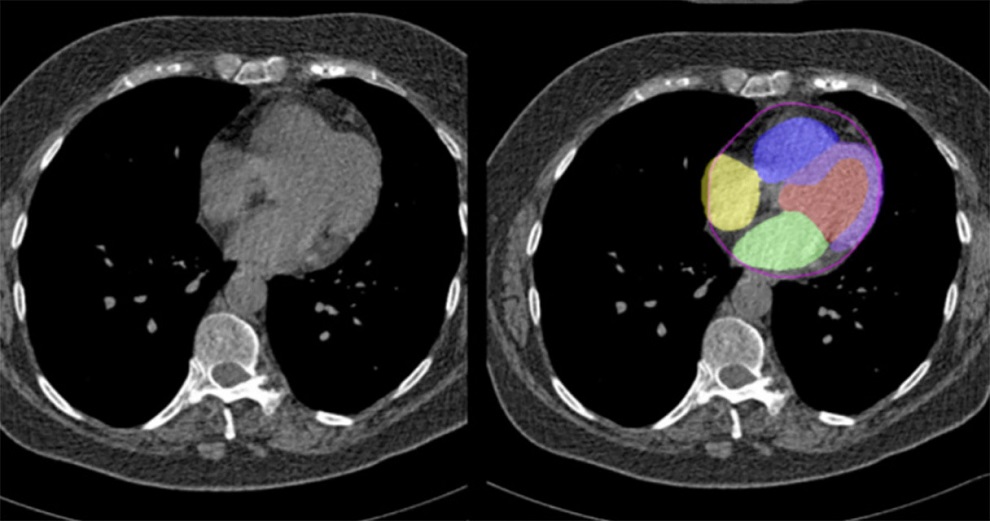

Artificial Intelligence Evaluates Cardiovascular Risk from CT Scans

Chest computed tomography (CT) is a common diagnostic tool, with approximately 15 million scans conducted each year in the United States, though many are underutilized or not fully explored.... Read more

New AI Method Captures Uncertainty in Medical Images

In the field of biomedicine, segmentation is the process of annotating pixels from an important structure in medical images, such as organs or cells. Artificial Intelligence (AI) models are utilized to... Read more.jpg)

CT Coronary Angiography Reduces Need for Invasive Tests to Diagnose Coronary Artery Disease

Coronary artery disease (CAD), one of the leading causes of death worldwide, involves the narrowing of coronary arteries due to atherosclerosis, resulting in insufficient blood flow to the heart muscle.... Read moreImaging IT

view channel

New Google Cloud Medical Imaging Suite Makes Imaging Healthcare Data More Accessible

Medical imaging is a critical tool used to diagnose patients, and there are billions of medical images scanned globally each year. Imaging data accounts for about 90% of all healthcare data1 and, until... Read more

Global AI in Medical Diagnostics Market to Be Driven by Demand for Image Recognition in Radiology

The global artificial intelligence (AI) in medical diagnostics market is expanding with early disease detection being one of its key applications and image recognition becoming a compelling consumer proposition... Read moreIndustry News

view channel

Bayer and Google Partner on New AI Product for Radiologists

Medical imaging data comprises around 90% of all healthcare data, and it is a highly complex and rich clinical data modality and serves as a vital tool for diagnosing patients. Each year, billions of medical... Read more