Global Medical Imaging Equipment Market Worth USD 45.3 Billion by 2023

|

By MedImaging International staff writers Posted on 22 Jul 2016 |

The global medical imaging equipment market is expected to grow at a CAGR of 5.6% from USD 29.4 billion in 2015 to USD 45.3 billion by 2023, driven by developments in computer-aided detection (CAD) and increased applications for imaging diagnostic applications due to advancements in 3D imaging technology.

These are the findings of Persistence Market Research Pvt. Ltd. (New York, NY, USA), a supplier of market intelligence reports and consulting services. Increased global demand for diagnosis and diagnostic equipment owing to rising incidences of respiratory, orthopedic, and cardiovascular diseases will further drive the market growth.

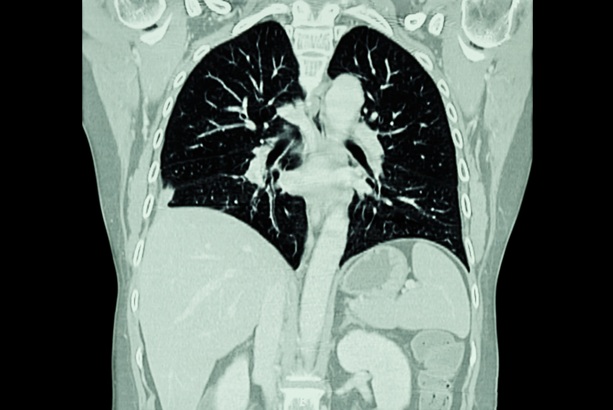

Based on product type, the global medical imaging equipment market is divided into X-ray devices, ultrasound devices, magnetic resonance imaging (MRI) equipment, computed tomography (CT) scanners and nuclear imaging equipment. In 2015, X-ray devices and ultrasound devices together accounted for around 50% of the total market share. There has been an increase in the demand for technologically advanced X-ray systems due to growing demand for bedside monitoring and a higher number of patients being treated through urgent care centers and emergency medical services. The growth in the sluggish mature X-ray imaging equipment segment has been further aided by digital X-ray systems, which have revolutionized X-ray imaging.

In 2015, the global portable X-ray devices market held a share of more than 40% in the X-ray devices market. Portable X-ray devices have high adoption rates, especially in emergency departments and ICUs, and are rapidly replacing stationary X-ray equipment due to the shift in user preference towards bedside imaging. Moreover, the rising trend of home healthcare is also leading to sales of stationary X-ray equipment slowing down.

In terms of regions, the global medical imaging equipment market is driven by the major developed economies of the US, Europe, and Asia Pacific, though the emerging markets, particularly China, India and Brazil, are expected to be the fastest growing markets in terms of CAGR from 2015 to 2023. In 2015, North America with a share of more than 30% was the largest market for medical imaging equipment due to increased awareness about medical imaging devices, financial strength for purchasing expensive equipment, growing demand for technologically advanced and innovative products across hospitals, diagnostics laboratories and outpatient ambulatory surgery centers, huge investment in improving healthcare infrastructure, and increasing healthcare expenditure.

The Asia Pacific region is the second largest market for global medical imaging equipment, driven by the demand for refurbished imaging systems due to low healthcare budgets. But China and India are increasingly adopting new devices with superior imaging, speed, flexibility and portability. Europe ranks third in terms of market size, with the demand for advanced equipment for all modalities being higher and Western Europe, which includes major economies such as Germany, U.K., France, and Italy, holding a major share.

Others markets include Latin America and Middle East & Africa. Market saturation in the developed world is forcing most players to focus on the emerging markets in Brazil and member states of Gulf Cooperation Council (GCC). Brazil’s proximity to the US is attracting major market players to set up manufacturing facilities in the region. Additionally, investments by the GCC member states towards improving their healthcare infrastructure and promoting medical tourism is aiding the demand for newer medical imaging equipment.

An increase in geriatric population will drive the demand for health care products and services as this segment is highly prone to respiratory (tuberculosis and pneumonia), oral, orthopedic (osteoporosis), and cardiovascular diseases. This is likely to result in increased usage of imaging equipment such as X-ray, ultrasound, MRI, and CT for accurately diagnosing such diseases, thereby driving the growth in the global medical imaging equipment market.

Increasing incidence of diseases, such as oral diseases and orthopedic conditions, which are diagnosed using X-ray equipment, and product enhancement and upgrade in the form of device portability are likely to drive the X-ray devices market. Digital X-ray systems will also contribute to the growth of the X-ray devices market in terms of revenue due to their rising demand globally. MRI, CT and ultrasound have allowed further options for treatment guidance essentially with very low morbidity, resulting in improved outcomes and quality of life for patients. Newer and better imaging technologies, including nuclear imaging and CT, are expected to witness high adoption levels by the end of 2023. Ultrasound devices are anticipated to witness a growth of around 7% from 2015 to 2023.

The key players in the global imaging equipment market are GE Healthcare (Little Chalfont, UK), Shimadzu Corporation (Kyoto, Japan), Philips Healthcare (Eindhoven, The Netherlands), Genesis Medical Imaging Inc. (Huntley, IL, USA), Hologic Inc. (Bedford, MA, USA), Siemens Healthcare (Erlangen, Germany), Samsung Medison Co. Ltd. (Seoul, South Korea), Carestream Health Inc. (Rochester, NY, USA), Hitachi Medical Corporation (Tokyo, Japan), Fujifilm Holdings Corporation (Tokyo, Japan), Toshiba Corporation Tokyo, Japan) and Fonar Corporation (Melville, NY, USA).

Related Links:

These are the findings of Persistence Market Research Pvt. Ltd. (New York, NY, USA), a supplier of market intelligence reports and consulting services. Increased global demand for diagnosis and diagnostic equipment owing to rising incidences of respiratory, orthopedic, and cardiovascular diseases will further drive the market growth.

Based on product type, the global medical imaging equipment market is divided into X-ray devices, ultrasound devices, magnetic resonance imaging (MRI) equipment, computed tomography (CT) scanners and nuclear imaging equipment. In 2015, X-ray devices and ultrasound devices together accounted for around 50% of the total market share. There has been an increase in the demand for technologically advanced X-ray systems due to growing demand for bedside monitoring and a higher number of patients being treated through urgent care centers and emergency medical services. The growth in the sluggish mature X-ray imaging equipment segment has been further aided by digital X-ray systems, which have revolutionized X-ray imaging.

In 2015, the global portable X-ray devices market held a share of more than 40% in the X-ray devices market. Portable X-ray devices have high adoption rates, especially in emergency departments and ICUs, and are rapidly replacing stationary X-ray equipment due to the shift in user preference towards bedside imaging. Moreover, the rising trend of home healthcare is also leading to sales of stationary X-ray equipment slowing down.

In terms of regions, the global medical imaging equipment market is driven by the major developed economies of the US, Europe, and Asia Pacific, though the emerging markets, particularly China, India and Brazil, are expected to be the fastest growing markets in terms of CAGR from 2015 to 2023. In 2015, North America with a share of more than 30% was the largest market for medical imaging equipment due to increased awareness about medical imaging devices, financial strength for purchasing expensive equipment, growing demand for technologically advanced and innovative products across hospitals, diagnostics laboratories and outpatient ambulatory surgery centers, huge investment in improving healthcare infrastructure, and increasing healthcare expenditure.

The Asia Pacific region is the second largest market for global medical imaging equipment, driven by the demand for refurbished imaging systems due to low healthcare budgets. But China and India are increasingly adopting new devices with superior imaging, speed, flexibility and portability. Europe ranks third in terms of market size, with the demand for advanced equipment for all modalities being higher and Western Europe, which includes major economies such as Germany, U.K., France, and Italy, holding a major share.

Others markets include Latin America and Middle East & Africa. Market saturation in the developed world is forcing most players to focus on the emerging markets in Brazil and member states of Gulf Cooperation Council (GCC). Brazil’s proximity to the US is attracting major market players to set up manufacturing facilities in the region. Additionally, investments by the GCC member states towards improving their healthcare infrastructure and promoting medical tourism is aiding the demand for newer medical imaging equipment.

An increase in geriatric population will drive the demand for health care products and services as this segment is highly prone to respiratory (tuberculosis and pneumonia), oral, orthopedic (osteoporosis), and cardiovascular diseases. This is likely to result in increased usage of imaging equipment such as X-ray, ultrasound, MRI, and CT for accurately diagnosing such diseases, thereby driving the growth in the global medical imaging equipment market.

Increasing incidence of diseases, such as oral diseases and orthopedic conditions, which are diagnosed using X-ray equipment, and product enhancement and upgrade in the form of device portability are likely to drive the X-ray devices market. Digital X-ray systems will also contribute to the growth of the X-ray devices market in terms of revenue due to their rising demand globally. MRI, CT and ultrasound have allowed further options for treatment guidance essentially with very low morbidity, resulting in improved outcomes and quality of life for patients. Newer and better imaging technologies, including nuclear imaging and CT, are expected to witness high adoption levels by the end of 2023. Ultrasound devices are anticipated to witness a growth of around 7% from 2015 to 2023.

The key players in the global imaging equipment market are GE Healthcare (Little Chalfont, UK), Shimadzu Corporation (Kyoto, Japan), Philips Healthcare (Eindhoven, The Netherlands), Genesis Medical Imaging Inc. (Huntley, IL, USA), Hologic Inc. (Bedford, MA, USA), Siemens Healthcare (Erlangen, Germany), Samsung Medison Co. Ltd. (Seoul, South Korea), Carestream Health Inc. (Rochester, NY, USA), Hitachi Medical Corporation (Tokyo, Japan), Fujifilm Holdings Corporation (Tokyo, Japan), Toshiba Corporation Tokyo, Japan) and Fonar Corporation (Melville, NY, USA).

Related Links:

Latest Industry News News

- GE HealthCare and NVIDIA Collaboration to Reimagine Diagnostic Imaging

- Patient-Specific 3D-Printed Phantoms Transform CT Imaging

- Siemens and Sectra Collaborate on Enhancing Radiology Workflows

- Bracco Diagnostics and ColoWatch Partner to Expand Availability CRC Screening Tests Using Virtual Colonoscopy

- Mindray Partners with TeleRay to Streamline Ultrasound Delivery

- Philips and Medtronic Partner on Stroke Care

- Siemens and Medtronic Enter into Global Partnership for Advancing Spine Care Imaging Technologies

- RSNA 2024 Technical Exhibits to Showcase Latest Advances in Radiology

- Bracco Collaborates with Arrayus on Microbubble-Assisted Focused Ultrasound Therapy for Pancreatic Cancer

- Innovative Collaboration to Enhance Ischemic Stroke Detection and Elevate Standards in Diagnostic Imaging

- RSNA 2024 Registration Opens

- Microsoft collaborates with Leading Academic Medical Systems to Advance AI in Medical Imaging

- GE HealthCare Acquires Intelligent Ultrasound Group’s Clinical Artificial Intelligence Business

- Bayer and Rad AI Collaborate on Expanding Use of Cutting Edge AI Radiology Operational Solutions

- Polish Med-Tech Company BrainScan to Expand Extensively into Foreign Markets

- Hologic Acquires UK-Based Breast Surgical Guidance Company Endomagnetics Ltd.

Channels

Radiography

view channel

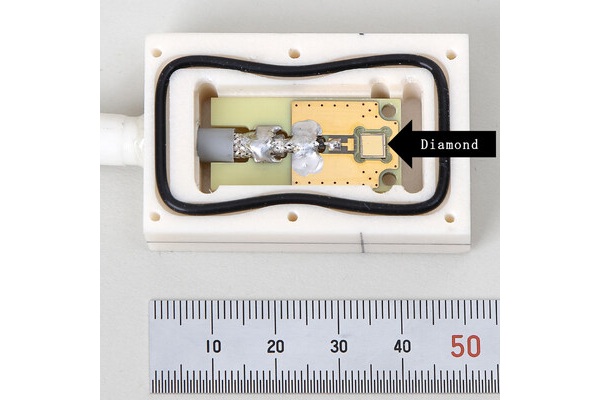

World's Largest Class Single Crystal Diamond Radiation Detector Opens New Possibilities for Diagnostic Imaging

Diamonds possess ideal physical properties for radiation detection, such as exceptional thermal and chemical stability along with a quick response time. Made of carbon with an atomic number of six, diamonds... Read more

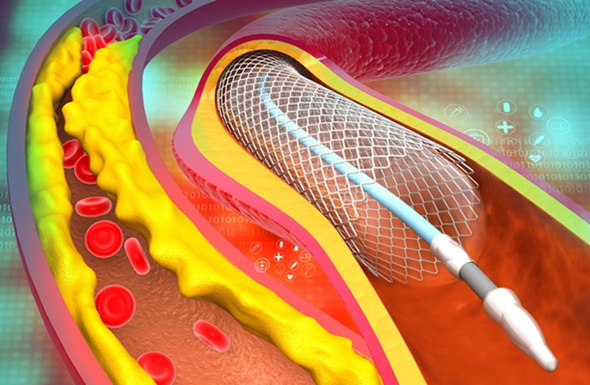

AI-Powered Imaging Technique Shows Promise in Evaluating Patients for PCI

Percutaneous coronary intervention (PCI), also known as coronary angioplasty, is a minimally invasive procedure where small metal tubes called stents are inserted into partially blocked coronary arteries... Read moreMRI

view channel

AI Tool Tracks Effectiveness of Multiple Sclerosis Treatments Using Brain MRI Scans

Multiple sclerosis (MS) is a condition in which the immune system attacks the brain and spinal cord, leading to impairments in movement, sensation, and cognition. Magnetic Resonance Imaging (MRI) markers... Read more

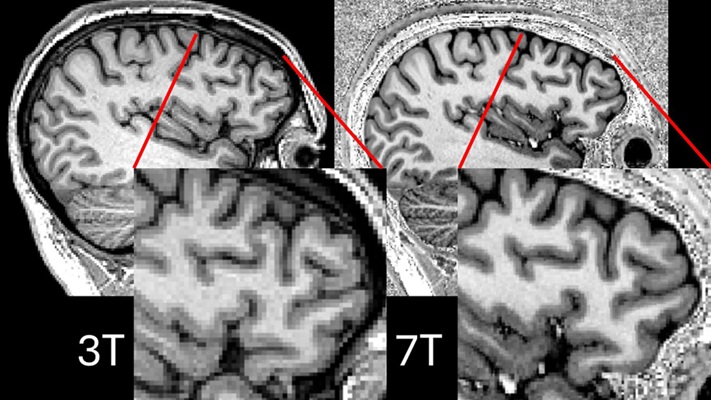

Ultra-Powerful MRI Scans Enable Life-Changing Surgery in Treatment-Resistant Epileptic Patients

Approximately 360,000 individuals in the UK suffer from focal epilepsy, a condition in which seizures spread from one part of the brain. Around a third of these patients experience persistent seizures... Read more

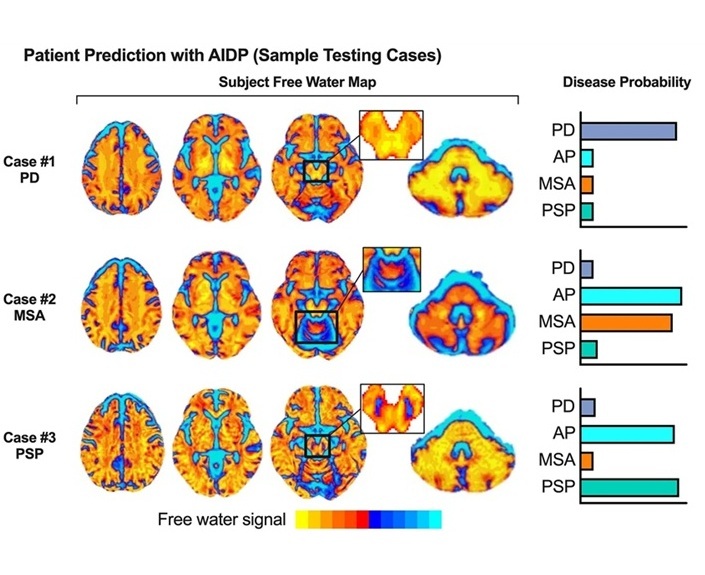

AI-Powered MRI Technology Improves Parkinson’s Diagnoses

Current research shows that the accuracy of diagnosing Parkinson’s disease typically ranges from 55% to 78% within the first five years of assessment. This is partly due to the similarities shared by Parkinson’s... Read more

Biparametric MRI Combined with AI Enhances Detection of Clinically Significant Prostate Cancer

Artificial intelligence (AI) technologies are transforming the way medical images are analyzed, offering unprecedented capabilities in quantitatively extracting features that go beyond traditional visual... Read moreUltrasound

view channel.jpeg)

AI-Powered Lung Ultrasound Outperforms Human Experts in Tuberculosis Diagnosis

Despite global declines in tuberculosis (TB) rates in previous years, the incidence of TB rose by 4.6% from 2020 to 2023. Early screening and rapid diagnosis are essential elements of the World Health... Read more

AI Identifies Heart Valve Disease from Common Imaging Test

Tricuspid regurgitation is a condition where the heart's tricuspid valve does not close completely during contraction, leading to backward blood flow, which can result in heart failure. A new artificial... Read moreNuclear Medicine

view channel

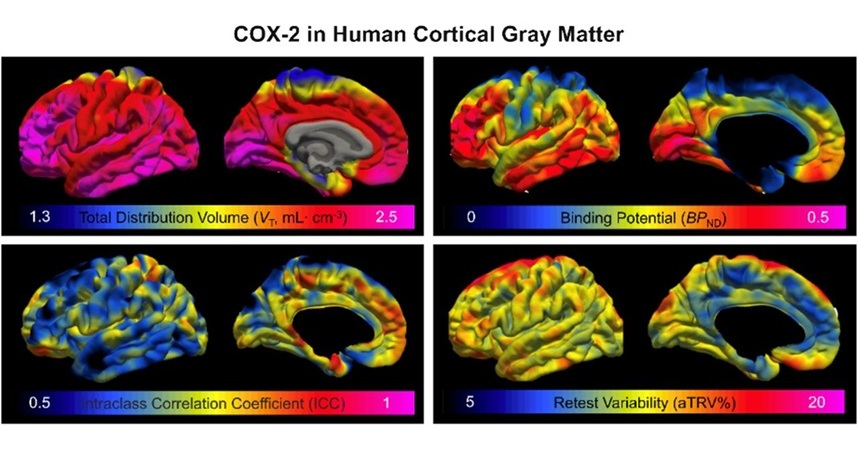

Novel PET Imaging Approach Offers Never-Before-Seen View of Neuroinflammation

COX-2, an enzyme that plays a key role in brain inflammation, can be significantly upregulated by inflammatory stimuli and neuroexcitation. Researchers suggest that COX-2 density in the brain could serve... Read more

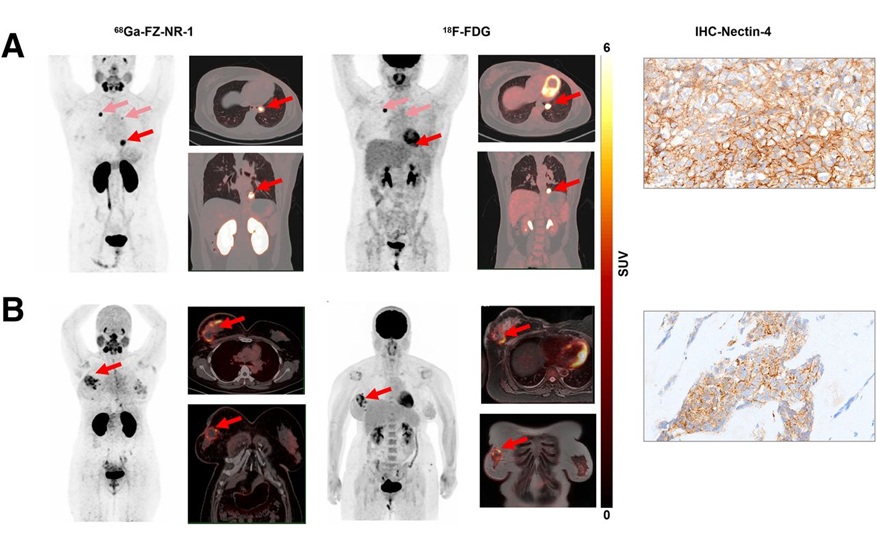

Novel Radiotracer Identifies Biomarker for Triple-Negative Breast Cancer

Triple-negative breast cancer (TNBC), which represents 15-20% of all breast cancer cases, is one of the most aggressive subtypes, with a five-year survival rate of about 40%. Due to its significant heterogeneity... Read moreGeneral/Advanced Imaging

view channel

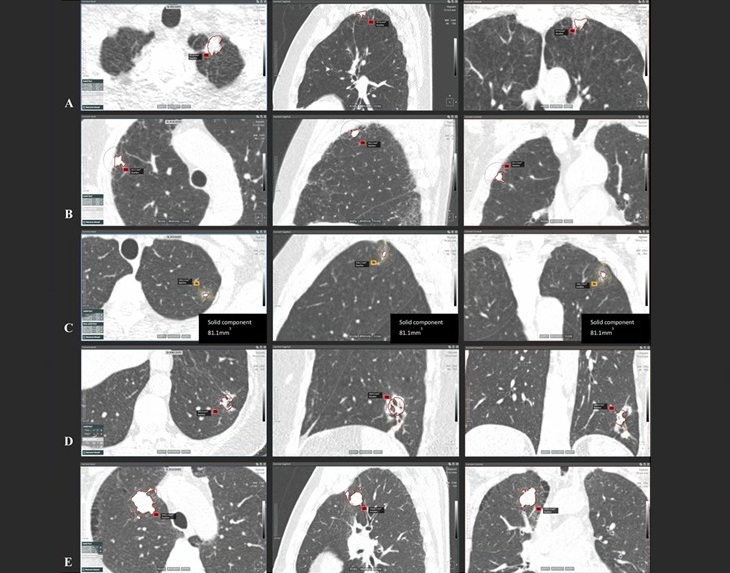

AI-Powered Imaging System Improves Lung Cancer Diagnosis

Given the need to detect lung cancer at earlier stages, there is an increasing need for a definitive diagnostic pathway for patients with suspicious pulmonary nodules. However, obtaining tissue samples... Read more

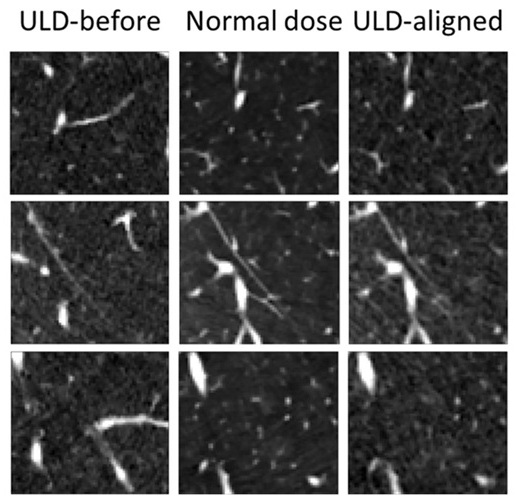

AI Model Significantly Enhances Low-Dose CT Capabilities

Lung cancer remains one of the most challenging diseases, making early diagnosis vital for effective treatment. Fortunately, advancements in artificial intelligence (AI) are revolutionizing lung cancer... Read moreImaging IT

view channel

New Google Cloud Medical Imaging Suite Makes Imaging Healthcare Data More Accessible

Medical imaging is a critical tool used to diagnose patients, and there are billions of medical images scanned globally each year. Imaging data accounts for about 90% of all healthcare data1 and, until... Read more

Guided Devices.jpg)