Global Breast Imaging Systems Market to Reach USD 1.3 Billion by 2024 Due to COVID-19-Led Patient Backlog

Posted on 27 Jan 2022

The global breast imaging market is expected to be driven by rising incidences of breast cancer, coupled with the huge backlog of women requiring breast cancer screening appointments due to COVID-19.

Other key growth drivers of the global breast imaging market include greater awareness of the benefits of breast cancer screening programs and the need to improve accuracy of breast cancer detection. This, alongside a patient-centric approach towards screening and technological advancements in order to enhance patient comfort, are improvements being implemented to increase participation of screening programs, which in turn, has driven the uptake of mammography X-ray equipment.

These are the latest findings of Signify Research (Cranfield, UK), a provider of market intelligence and consultancy to the global healthcare technology industry.

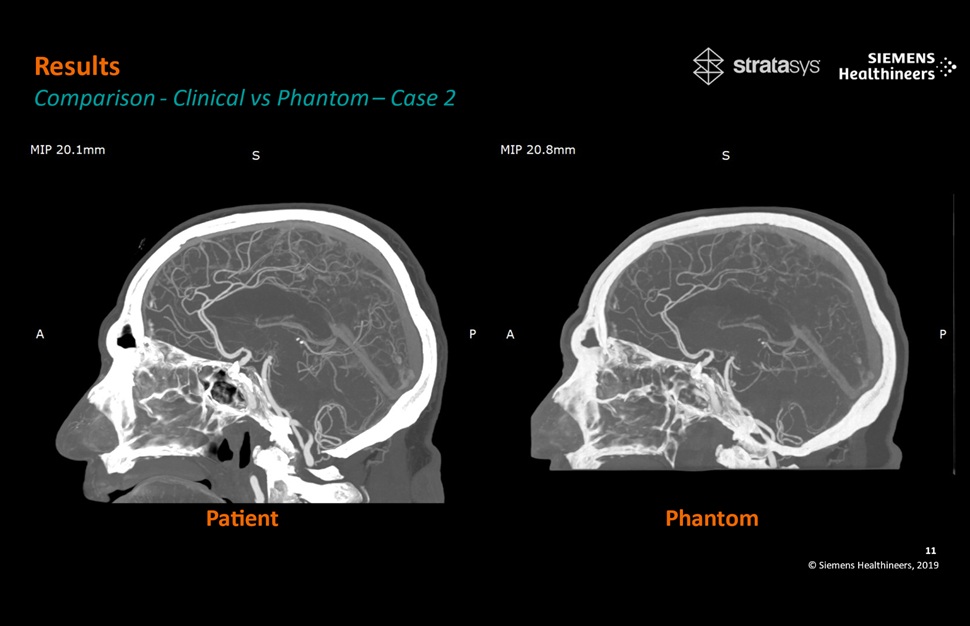

As a result of the rise in breast cancer cases globally, there is heightened pressure on governments for conducting screening programs. However, screening programs alone are not sufficient to help bring down breast cancer mortality rates. It is essential to improve the accuracy of breast cancer detection, while also reducing false positives and missed lesions. These factors are expected to primarily drive advancements in breast imaging screening as well as diagnosis.

COVID-19 severely impacted all medical procedures and healthcare facilities since the pandemic was declared globally in March 2020. Breast screening was significantly affected, with a high number of women missing their scheduled mammograms. With a significant number of women missing their screening appointments, there is concern that many more women will develop breast cancer in the advanced stages over the coming years. To help deal with the patient backlog, significant investment will be needed in both medical staff and breast imaging equipment. Given the increased pressure on screening centers and hospitals to address the number of women requiring breast cancer screening, there is heightened interest in how artificial intelligence (AI) can be used to help prioritize scans, by highlighting suspected cases or lesions. Cases that are most urgent can then be taken up on a higher priority within the radiologists’ workflow, accelerating patient care pathways or protocols for further diagnosis.

Mammograms will continue to play a fundamental role in the detection of breast cancer, although the occurrence of false positives often leads to benign lesions being operated on. Given the heightened pressure for breast cancer screening programs to tackle the rising female population qualifying for mammography screening, it is crucial that the number of false positives subsequently does not rise as a result. Advanced techniques in mammography screening such as AI, tomosynthesis guided biopsy, contrast enhanced spectral mammography, as well as a more personalized approach to breast cancer screening are initiatives which could help reduce the number of false negatives or positives and drive more accurate, early detection of breast cancer.

The trend of personalized risk-based screening is expected to gain strength. A number of factors could contribute to the risk of breast cancer such as genetics, family history, polygenic risk scores and high mammographic density. Personalized risk-based screening can also identify high-risk women for more intensive screening such as magnetic resonance imaging (MRI) follow-up after mammography. Alternatively, low-risk women may be more suited to longer intervals between screening, which also reduces the risk of false positives through over-screening. There will also be an increase in the use of multi-modality imaging for breast cancer screening. The shift towards risk-based screening is likely to encourage the use of multi-modality imaging. As women are segregated into groups, identification factors, such as increased breast density, are expected to facilitate supplemental screening that is not commonly practiced today.

Regarding the use of 2D vs. 3D mammography in screening programs, the US is the only country in the world that currently uses 3-D mammography for screening, while all other countries use this technology only for diagnostic purposes. Western European countries are expected to be the next to adopt 3-D mammography screening programs, although this is not likely to happen until the next two to three years. In addition, healthcare providers are considering changing breast cancer screening policies to include younger demographics in order to help reduce breast cancer-related deaths and increase early detection. However, the possibility of over-diagnosis and false positives is still prevalent.

There continues to be a significant discrepancy across the world with regard to screening programs. Countries with large populations, like China and India for example, do not have a formal, structured approach towards screening. There are also large differences in participation even in regions where formal programs exist, such as in Western Europe. In Spain, Denmark and Finland there is around 80% participation, whereas the participation rates in other countries like France, the DACH region (Germany-D, Austria-A, and Switzerland-CH) and Portugal are all significantly below the 50% mark. The European Union is attempting to increase participation and increase the adoption rates to 80% or above.

Related Links:

Signify Research