Upturn for the MRI Market Predicted for 2011

By MedImaging International staff writers

Posted on 07 Mar 2011

Unlike ultrasound and X-ray markets, the "big-iron" imaging markets, computed tomography (CT) and magnetic resonance imaging (MRI) have suffered significantly due to the global economic recession. However, in of the current economic environment MRI is making a resurgence, according to new market research.Posted on 07 Mar 2011

A new report from InMedica (Wellingborough, UK), a medical device marker research company, emphasized small pockets of growth; with manufacturers focusing on technology advancements that will not only increase the workflow efficiencies, but significantly, also better the patient experience of being scanned.

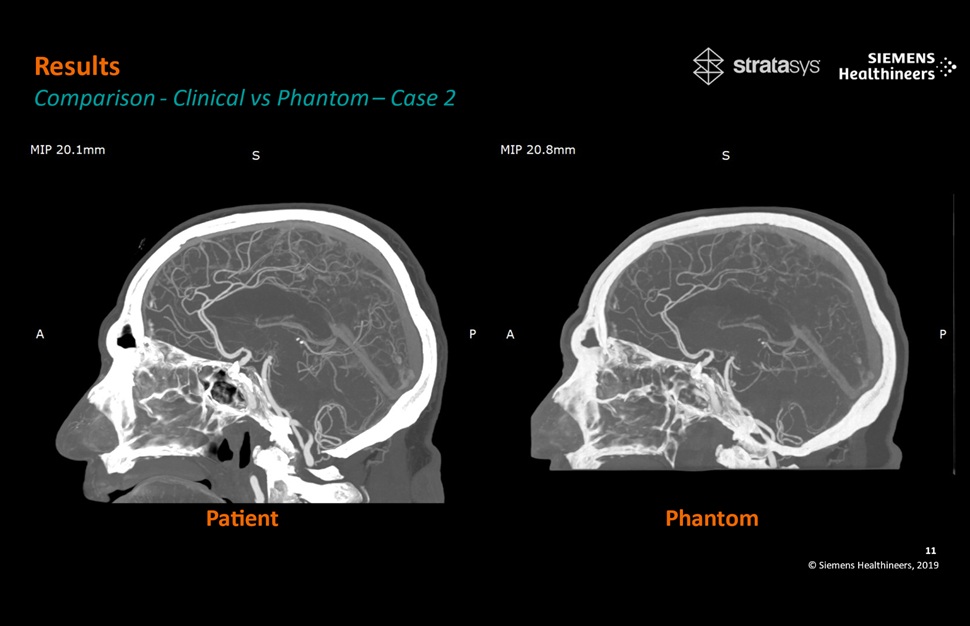

After additional decline of the global MRI market in 2010, InMedica projects market recovery from 2011; postrecession, global unit shipments are forecast to increase to nearly 4,000 by 2014, a compound annual growth rate (CAGR) of 6.0%. "The latest technological developments for MRI focus on higher resolution and higher contrast images, enhanced workflow, faster scan-times, and increased patient throughput. Bore-size is also a consideration; all aim to maximize productivity and improve patient comfort," commented Diane Wilkinson, research manager at InMedica. "In addition, the MRI market is also seeing demand in an increasing number of applications such as interventional and functional MRI, as well as its continued integration with other modalities such as ultrasound. New noncontrast agent techniques [spin-labeling], for example, in angiography, are also now available; an exciting development after the issues that have surrounded contrast imaging over the last few years and of further benefit to the patient."

The recurring theme through all of this, however, is cost-efficiency. Ensuring sufficient return on investment (ROI) is one of the most important considerations for any MRI purchase. Combined with global restructuring of healthcare investment and continuing restrictions on reimbursement (particularly in the United States), suppliers must look for new innovations to help renew growth in the industry, while maintaining ROI for the customer, according to InMedica analysts.

Growth in the global MRI market is additionally driven by the continuing trend to higher-field strengths in both open and cylindrical MRI; in fact, the global ultra-high field market (defined by InMedica as cylindrical systems of 3.0 Tesla and above) grew year-on-year throughout the recession. Moreover, it is one of only two market segments forecast with revenue and unit growth in 2011 and 2012. Moreover, extremity MRI is presenting itself as a growing niche market.

But will the current financial environment allow MRI to reach its potential? InMedica predicts that 2011 will be the turning point for MRI: orders previously deferred or cancelled are beginning to be placed, the demand for new applications of MRI is increasing, and enhanced patient workflow is continuing to maximize profitability. 2010 was still a hard year for some MRI manufacturers; while 2011 will remain challenging, far more promise can be seen.

Related Links:

InMedica