Medical Imaging Market Increases in Demand, Utilization for High-Tech Imaging and Need for Replacement Systems

By MedImaging International staff writers

Posted on 02 Aug 2010

The medical imaging market is expected to recover from the adverse effects of the economic slump and the considerable decline in reimbursement. The instigators behind this reformation would be new developments in technology and new clinical applications for imaging modalities. Posted on 02 Aug 2010

While the ongoing economic downturn continues to hamper businesses worldwide affecting major markets in the United States and Europe, countries such as India and others in the Asia Pacific are expected to come out intact. This is due to the demand for healthcare along with the increasing ability of the patient population to spend on improved health services in these regions.

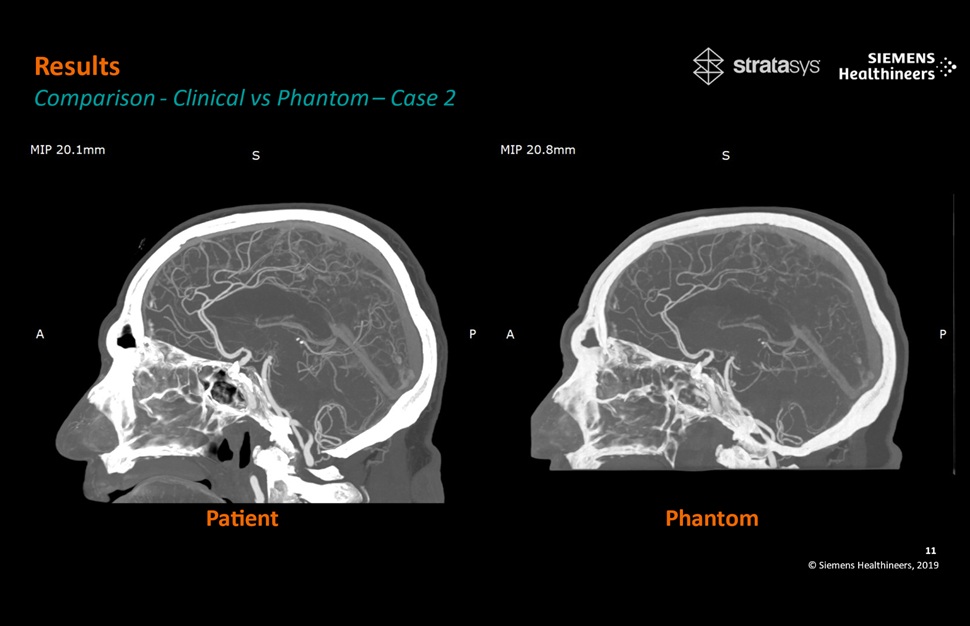

New analysis from Frost & Sullivan (Palo Alto, CA, USA), an international growth consultancy company, revealed that the market earned revenues of US$5.73 billion in 2009 and estimates this to reach $6.55 billion in 2012. The market segments covered in this research include computed radiography and digital radiography (CR & DR), magnetic resonance imaging (MRI), computed tomography (CT), three dimensional (3D), and computer-aided detection (CAD), ultrasound, C-arms, imaging informatics, contrast media and auto injectors, mammography, molecular imaging and nuclear medicine.

"The medical imaging market is shifting towards integrated technology and hybrid systems with innovative developments such as radiation reduction and better temporal resolution,” stated Frost & Sullivan research associate Simone Carron. "Radiation reduction is a growing trend across Europe and clinicians are looking at significantly optimizing examination time.”

The factors considered during the purchase of medical imaging equipment are radiation dosage, throughput, and speed of the exam. The increasing development is towards enhanced temporal resolution, which can provide clinically relevant structures and pathology instead of only more data or slices.

Even though healthcare is one of the least-affected sectors by the financial crisis, it experienced a slowdown in the flow of easy credit. Funding from government and central banks are subject to new regulations and rules to negate the chances of another downturn. "The downturn also drives end-users to delay purchase of new equipment thereby lengthening product replacement cycle,” explained Ms. Carron. "This in turn is likely to necessitate vendors to provide long-term technology sustainability.”

Companies should secure capital and decide future strategies to counteract the adverse effects of the economic slump. "Private financing sectors are expected to raise capital and improve the outlook of the imaging modality market,” concluded Ms. Carron. "Additionally, technological integration and the likely growth of hybrid modalities offering better throughput with reduced dosage and examination time are expected.”

Related Links:

Frost & Sullivan