Growing Potential of Cardiac CT Capabilities and Increase of New Clinical Applications Fuel Growth of European CT Markets

By HospiMedica staff writers

Posted on 27 Sep 2007

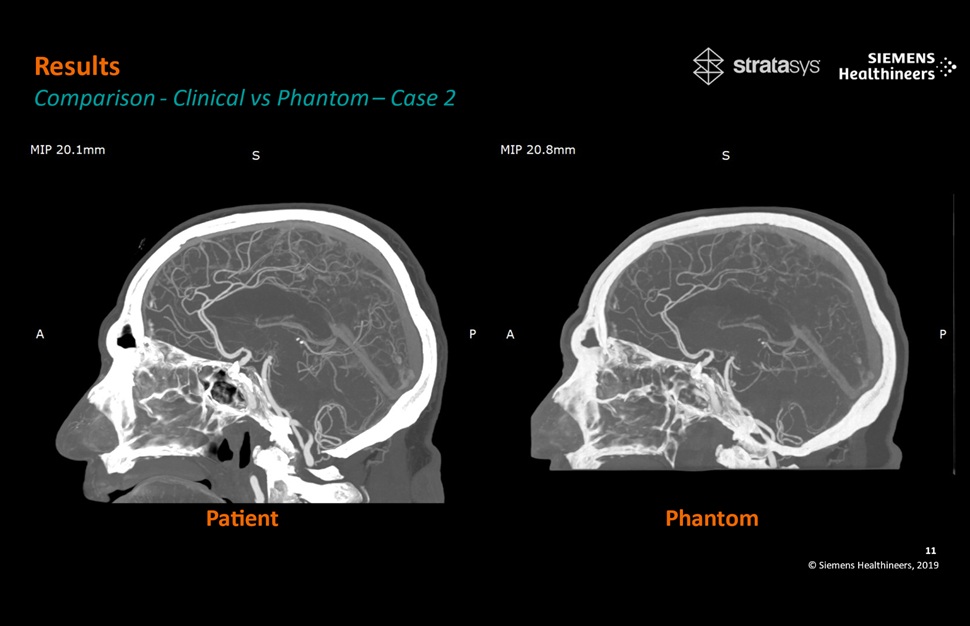

The increasing potential of cardiac imaging applications combined with the capacity for innovation in the clinical application potential for computed tomography (CT) imaging and continual improvement in speed of scans are principally driving the European CT systems market. Posted on 27 Sep 2007

Moreover, as different countries in the European Union are in diverse stages of the replacement cycle, constant replacement sales are likely to ensure growth in revenues. New analysis from Frost & Sullivan (Palo Alto, CA, USA), an international growth consultancy company, found that the market earned revenues of US$861.7 million in 2006 and is positioned to grow at a compound annual growth rate (CAGR) of 4.0% from 2006 to 2013, to reach $1.14 billion in 2013.

"At present, computed tomography angiography [CTA] and virtual colonoscopy are the most promising applications,” noted Frost & Sullivan research analyst Divya Bhaskaran. "However, with the introduction of higher slice scanners, the market is set to move towards ‘single heartbeat' cardiac imaging.”

Because a 16-slice scanner is adequate for most traditional radiology applications, most customers are adopting the ‘wait and watch' approach, purchasing a standard 16-slice system but delaying the purchase of the additional high-end scanner. The lack of differentiation between reimbursement for low-end and high-end CT equipment is also another reason.

Aside from reimbursement issues, the European CT systems market is faced with other challenges such as pricing pressures and competition from magnetic resonance imaging (MRI), according to Frost & Sullivan. Furthermore, whereas higher slice CT scanners enable faster scans, they also result in greater radiation dose with every higher slice count scanner. Additionally, there is also the inherent challenge arising due to competition from MRI.

"Industry participants should concentrate on introduction of new software to stem price erosion, and as an additional source of revenue, as they can be sold to the existing installed base of CT scanners,” commented Ms. Divya. "Means to address the radiation dose concern should also be given immediate utmost importance.”

Nonetheless, the European CT systems market is still growing with a lot of range for innovation in software and clinical applications, according to Frost & Sullivan.

Related Links:

Frost & Sullivan

Guided Devices.jpg)