Full-Service Contracts Drive European Imaging Market

By MedImaging staff writers

Posted on 21 Mar 2006

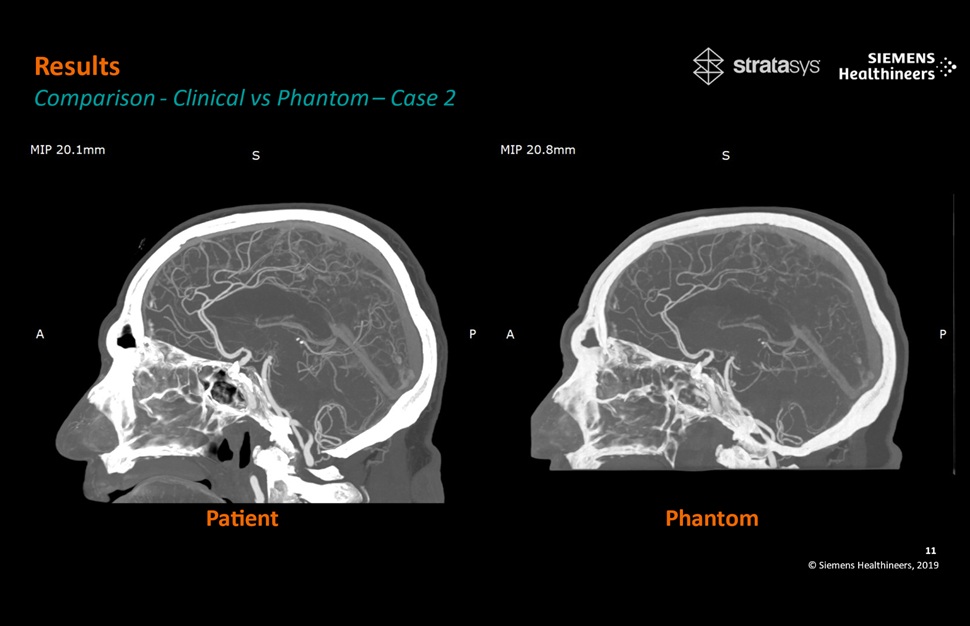

An increasing installed base of higher-end medical imaging equipment modalities, such as computed tomography (CT) and magnetic resonance imaging (MRI), are driving the uptake of related vendor-based services. Specifically, such higher-end modalities will boost the adoption of full service agreements, a trend reinforced by the need to continuously minimize equipment downtime, according to a new report from Frost & Sullivan (Palo Alto, CA, USA), an international consulting firm.Posted on 21 Mar 2006

The medical imaging equipment services markets in Europe earned revenues of U.S. $1041.1 million in 2004 and are estimated to reach $1195.7 million in 2011. "Healthcare administrators are facing increasing pressure to operate along the lines of financial accountability within strict budget allocations,” remarked Frost & Sullivan research analyst Martin Bryant.

Specifically, the increasing cost of maintaining high-end medical imaging equipment on a time and materials basis is forcing healthcare administrators to streamline service costs by making quantifiable yearly payments in the form of full-service agreements. Service contract fees for such advanced modalities are noticeably higher than for lower-end ones, with installation and training costs also presenting a steady revenue stream.

Nevertheless, as hospital administrators try to reduce costs in noncore areas such as service contracts for equipment, they are expected to demand more services at lower prices, thus constricting service providers' profit margins. To achieve crucial cost savings and induce end users to make large budgetary allocations, service providers will, therefore, need to ensure high performance standards and continual innovations.

Service contracts will continue growing because of the ability of remote diagnostics to meet radiology departments' maintenance requirement. By automatically monitoring the radiology installed base and warning vendor service centers if any equipment is showing signs of failing, remote diagnostic services are vital to accelerating response times for hospitals based in distant locations.

Furthermore, in spite of substantial initial outlays, remote diagnostics provide long-term cost-savings to vendors that no longer need sustain heavy expenditures on dispatching engineers to repair sites. As these savings eventually trickle down to end users, service contracts will become increasingly attractive to hospitals in nonrural settings as well.

Related Links:

Frost & Sullivan